If you are a UAE-based business or individual earning income internationally, you may be subject to foreign tax. Fortunately, the Foreign Tax Credit (FTC) helps you avoid double taxation by allowing relief for taxes paid abroad. At Alamtar Accounting & Bookkeeping, we provide professional guidance to ensure your Foreign Tax Credit is fully optimized under UAE’s corporate tax framework — helping you stay compliant and minimize your global tax burden.

The Foreign Tax Credit allows businesses or individuals to claim a credit against UAE corporate tax for income tax already paid in another country. This mechanism ensures you aren’t taxed twice on the same income — once abroad and once in the UAE.

📌 With the introduction of corporate tax in the UAE, claiming FTC has become crucial for businesses operating across borders.

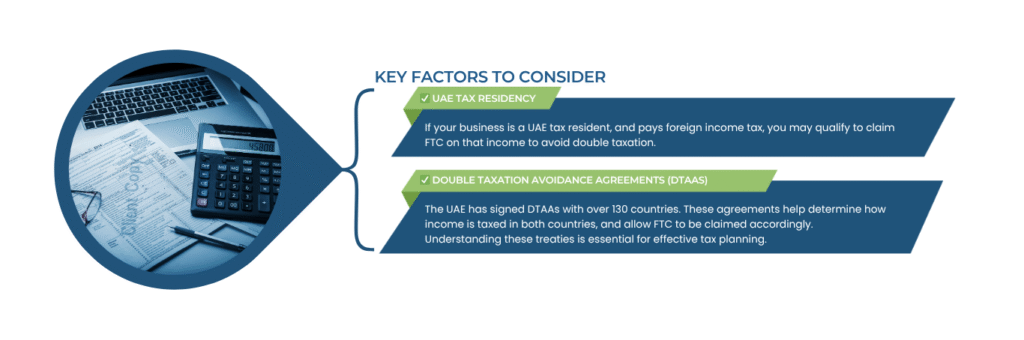

UAE does not levy personal income tax, but corporate tax applies to business profits. If your UAE-registered business is earning income overseas and paying taxes on it, you may qualify for FTC.

Here’s how it works:

We evaluate your tax structure and income streams to identify your FTC eligibility and the best strategies to apply.

We review and apply relevant Double Taxation Avoidance Agreements to ensure full benefits are utilized.

Our experts calculate your eligible tax credit amount and ensure proper documentation for UAE tax filings.

We prepare and file FTC claims, maintain supporting documents, and handle all required submissions.

We offer tax planning solutions to help you structure international operations in the most tax-efficient manner.

Facing a tax audit or query related to FTC? Our team provides complete support and defense with tax authorities.

We understand UAE corporate tax laws and international tax treaties.

Every FTC solution is customized to your unique business and industry.

From tax residency advice to audit defense, we cover it all.

We ensure timely submissions to help you avoid penalties or missed credits.

Operating across borders? Don’t let double taxation affect your bottom line.

Let’s Talk Numbers — We’re Here to Help